when are property taxes due in illinois 2019

The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. Property tax due dates for 2019 taxes payable in 2020.

9 Hidden Income Tax Return Benefits Tips You Need To Learn Now Income Tax Return Income Tax Tax Return

Payment can be made by.

. When are property taxes due in illinois 2019 Sunday March 6 2022 Edit. January 1 2020 - New Years Day. In most counties property taxes are paid in two installments usually June 1 and September 1.

Enjoy online payment options for your convenience. Tuesday March 1 2022. Learn how the County Board has kept the tax levy flat for Fiscal Years 2020 and 2021.

3 penalty interest added per State Statute. Ad Prepare and file 2019 prior year taxes for Illinois state 1799 and federal Free. Collecting property taxes on real estate and mobile homes.

Online payments will be available again starting approximately May 31 2020 and ending November 27 2020 at 400 pm. Will County collects on average 205 of a propertys assessed fair market value as property tax. 2020 Final Taxing Bodgy Distribution Report as of 11-18-21.

Box 1216 Rockford IL 61105-1216. To avoid any late penalty the payment must be made on or before due date. The Illinois Department of Revenue does not administer property tax.

If you have delinquent taxes for Tax Year 2019 they will be offered at the 2019 Annual Tax Sale which begins May 12. In fiscal year 2019 property taxes comprised 31 percent of total state and local tax collections in the United States more than any other source of tax revenue. Welcome to Jo Daviess County Illinois.

Contact your county treasurer for payment due dates. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a. Property tax bills mailed.

A United States Postal Service postmark is accepted as date of payment in the calculation of a late penalty. Check to see if your taxes are past due. Illinois HB5768 2019-2020 Amends the Property Tax Code Provides that if a disaster is declared by proclamation of the Governor for all counties in the State due to a public health emergency then the due date for the first installment of property taxes due in that calendar year shall be delayed by 90 days and no penalties or interest shall accrue during that extension Effective.

Friday October 1 2021. 2018 Tax Bill Listing by Township. This page is your source for all of your property tax questions.

How to Pay Your Tax Bill. If you are a taxpayer and would like more information or forms please contact your local county officials. 2nd installment due September 3 2019.

Click the blue box to pay online for free. Pay tax bills online. Tax Year 2020 Second Installment Due Date.

2018 Final Taxing Body Distribution Report as of 11192019. Martin Luther King Jrs birthday. 15 penalty interest added per State Statute.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax. Will County has one of the highest median property taxes in the United States and is ranked 34th of the 3143 counties in order of median property taxes. Connecticut Ranked 48th For Property Taxes As State Deficits Threaten To Drive Them Higher Yankee Institute Property Tax Prorations Case Escrow.

45 penalty interest added per State Statute. In the calendar year 2019 we will be paying real estate taxes for the 2018 year. 1st installment due date.

View maps of different taxing districts in Lake Countys Tax District Map Gallery. Last day to submit changes for ACH withdrawals for the 1st installment. Property TaxesMonday - Friday 830 - 430.

Goral Winnebago County Treasurer PO. If taxes are not paid after the second installment date in addition to the penalty additional fees may be added. Tax Year 2020 First Installment Due Date.

Tuesday March 2 2021 Late Payment Interest Waived through Monday May 3 2021 Tax Sales 2022 Scavenger Sale. Even if the payment is. Macon County Property Tax Information.

Any property owner may pay their second installment of the 2019 property tax by October 1 without any penalties or late fees. 2018 Real Estate Property Taxes Payable 2019 Due Dates. Welcome to Madison County Illinois.

Illinois is extending the 2019 tax year filing and payment due date for C corporations who file Form IL-1120 from April 15 2020 to July 15 2020. The delayed property tax payment enables property owners an additional two 2 months to pay their taxes that were originally due on August 3. Prepare your 2019 state tax 1799.

Online Payments Online payments are only available during a portion of the tax collection period. Welcome to Property Taxes and Fees. 1st installment due June 3 2019.

Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. It is managed by the local governments including cities counties and taxing districts. Illinois is not extending the filing or payment due dates for tax year 2019 returns for partnerships including nonresident withholding Form IL-1065 which still falls on April 15 2020.

Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due. Property TaxesMonday - Friday 800 - 400. 100 Free Federal for Old Tax Returns.

The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. When are property taxes due in illinois 2019 Thursday March 3 2022 Edit. There are many offices that hold different pieces of information about your property tax and this page is intended to get you to the answer with as few clicks as possible.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. See how your individual property taxes are distributed for any parcel and how to contact those taxing bodies on Lake Countys Tax Distribution website. 2019 Final Taxing Body Distribution Report as of 11-20-20.

Tax Year 2021 First Installment Due Date. Monday February 14 through Tuesday March 2 2022 2019 Annual Sale. January 20 2020 - Dr.

Penalty be assessed for payments made after the due date. State law requires a 15 percent interest fee per month on late payments. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Mail your tax bill and payment to. Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes. American Express Visa MasterCard and Discover credit cards see Convenience Fee Schedule below An added fee.

What S Being Done To Reduce High Property Taxes In Illinois Property Tax Estate Tax Illinois

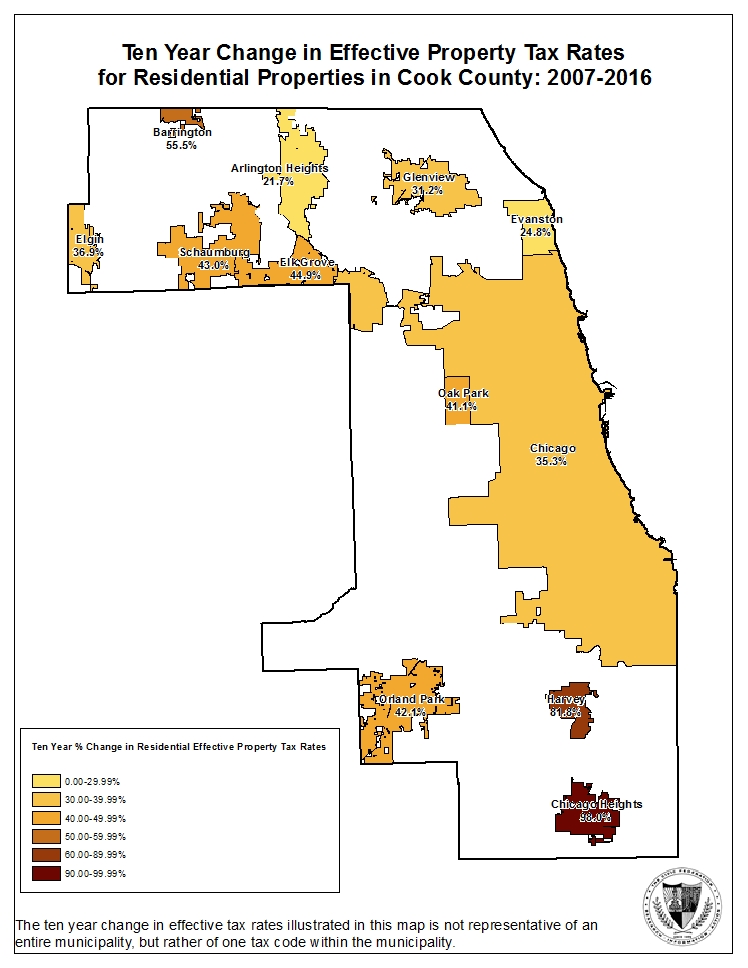

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Being Pre Approved Makes Your Offer More Attractive It Can Take As Little As A Few Hours But Can Save Weeks O Las Vegas Real Estate Real Estate Tips Messages

The Top 5 Real Estate Stories Of 2019 What Events Rocked The World Of Philadephia Real Estate This Year Here Are Real Estate Estates Property Development

Property Tax City Of Decatur Il

Untitled Exit Strategy Suburban Veterans Day

Tax Information Village Of River Forest

At Least Bloomington Is Honest Now Bloomington Buying Property Hawaii Travel

Screenshot California Enacts Marketplace Nexus Provisions Changes Economic Nexus Threshold Sales Tax Institute Sales Tax Nexus Tax

Pin By Charlesa Young On Books Worth Reading Glenwood Property Peoria

Pin By Keiram On We Hunt The Flame Sentences Chemistry Ya Fiction

State By State Guide To Taxes On Retirees Retirement Income Income Tax Tax Free States

Property Tax City Of Decatur Il

Now Let Us Explore Which Department Is Known For Its Tax Crime Investigation And Later We Will Add A Few Basic St Business Lawyer Tax Attorney Criminal Justice

Property Tax Village Of Carol Stream Il

The Cook County Property Tax System Cook County Assessor S Office